As global manufacturers de-risk from China and search for new technology hubs, India looks like one of the world’s most powerful centres for smartphone R&D.

As per a PIB report, India has grown from having only two mobile manufacturing units in 2014 to over 300 units today.

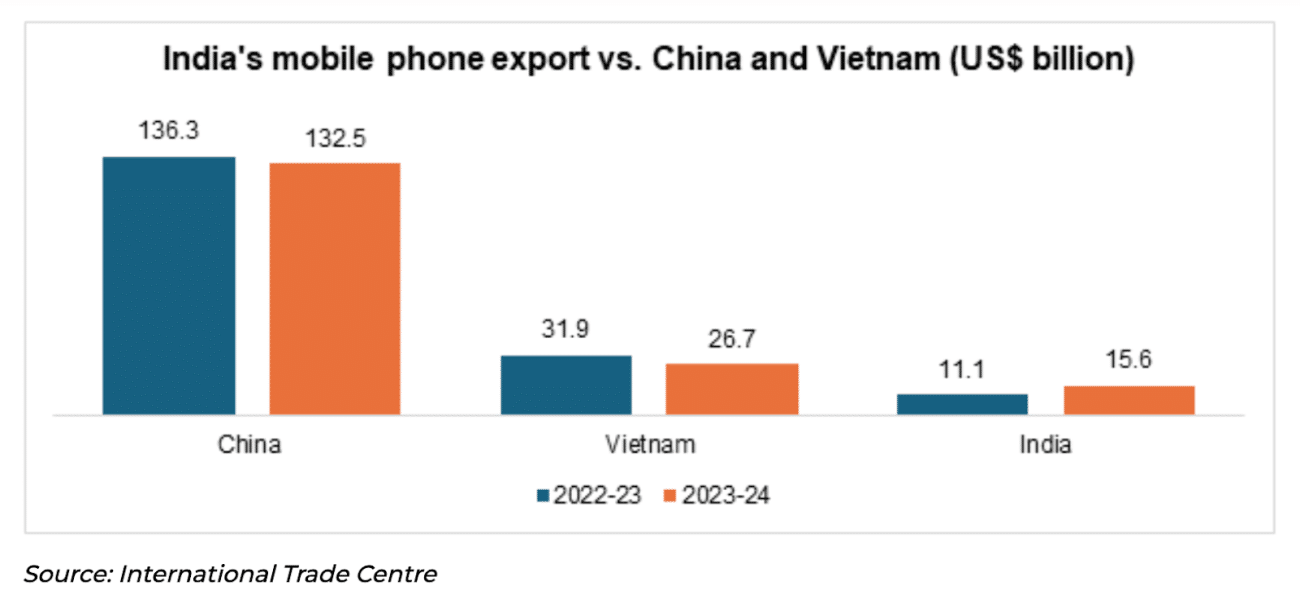

The country, though, faces stiff competition from China and Vietnam, both of which have cemented their positions as global electronics export powerhouses.

As per reports, in 2023-24, China and Vietnam saw export declines of 2.78% and 17.6%, respectively, while India’s exports grew by over 40%.

According to the International Trade Centre, as reported, China’s mobile phone exports dropped by $3.8 billion, and Vietnam’s fell by $5.6 billion.

In contrast, India gained $4.5 billion in exports, capturing nearly half of the combined decline from both China and Vietnam.

The gap underscores the scale at which these nations operate, and also the significant headroom India has to expand its electronics exports by strengthening and optimising domestic manufacturing and supply-chain capabilities.

Talking to AIM, Karn Chauhan, senior analyst at Counterpoint Research, mentioned that under the companies’ China+One strategy, one in five smartphones in the world is now made in India, and production is up by 11% in H1 2025.

Meanwhile, the ‘Make in India’ initiative has enabled the domestic production of critical components and sub-assemblies such as chargers, battery packs, mechanics of all types, USB cables, and more complex components like Lithium Ion Cells, speaker and microphones, display assemblies and camera modules.

The ecosystem is also expanding beyond assembly into components. Suppliers like Salcomp and TXD are operating in India, and new entrants are arriving—Foxconn-backed Yuzhan Technologies has begun pilot display production, while several China–India joint ventures, such as Bhagwati–Huaqin, Dixon–Longcheer, and Dixon–QTech are taking shape despite Press Note 3 restrictions. PN3 imposes restrictions on Foreign Direct Investment (FDI) from countries that share a land border with India, requiring prior government approval for any such investment.

“The country already assembles almost all phones sold domestically and is expanding into exports, which grew 25% year-on-year in Q3 2025. Apple entering India’s top five OEMs for the first time underscores this momentum,” Chauhan mentioned.

Furthermore, the electronic components manufacturing scheme is expected to deepen local capabilities in PCBs, displays, camera modules and enclosures, enabling Indian assemblers to secure stronger ecosystem partners.

However, the shift will be gradual, not immediate.

Chauhan added, “India still needs time to build end-to-end component maturity. China and Vietnam will continue to play key roles. Vietnam remains a major export hub for Samsung, and China will stay essential for deep components, tooling, and ecosystem scale during this transition.”

How HMD Gcc is Driving the Narrative

At HMD Global, this change is already underway. What began as an India engineering team supporting global markets, has evolved into a full-stack capability for product design, testing, AI development, and device innovation, built in India, for the world. The company constitutes the mobile phone business that the Nokia Corporation sold to Microsoft in 2014, was then bought back in 2016 by former executives, who formed HMD Global.

Ravi Kunwar, CEO and VP of HMD, India and APAC, told AIM that the company does R&D here for many markets, including Australia, Vietnam, Indonesia and more. “Some of these phones are not even sold in India, but all the testing happens here,” Kunwar said, adding that this is not a back-office operation, but core product development.

As a GCC in India, HMD is leveraging depth of STEM talent, speed of execution, and the ability to test products across complex real-world conditions.

Kunwar emphasised that “Make in India” is crucial for HMD, as it enables both global competitiveness and deeper localisation. “Making a product in India allows us to be globally competitive,” he said, referring to the PLI scheme. HMD’s 95% products are now locally manufactured, enabling cost-competitive, high-quality exports to markets like the Middle East and Africa.

He added that the Component Link Policy “goes beyond assembling and manufacturing by focusing on the localisation of each and every component,” with Phase Two incentives further strengthening HMD’s supply chain.

“India today has some of the best engineers globally, especially in hardware, AI and system design. The diversity of our market makes India the perfect testbed for global hardware,” Kunwar noted.

Beyond testing, India now leads complete device development cycles, from industrial design and prototyping to software tuning and field performance validation.

The result being two of HMD’s fastest-growing devices globally, the HMD Vibe 5G and HMD Touch 4G, were conceptualised, designed and engineered in India. “Both these devices are now being taken to global markets, fully designed in India,” Kunwar confirmed.

Very few nations outside China, the US, South Korea, and parts of Europe can claim full-cycle smartphone creation capabilities.

A new AI philosophy: “Before A is H”

As the global smartphone industry pivots from hardware-first to AI-first, Kunwar said that the company is building an India-led philosophy around meaningful, accessible innovation.

“Before A is H,” Kunwar quipped, as he elaborated: “Before Artificial Intelligence, we think Human Intelligence. AI must be useful and grounded. Not gimmicky.”

This thinking is driving a wave of device intelligence that doesn’t require flagship hardware or premium pricing. Instead, the focus is on real user problems such as battery life, accessibility, rural connectivity, and security enhanced by AI models optimised for modest compute environments.

And India, with its vast mid-market user base and affordability-driven innovation culture, is the natural birthplace for this shift.

The global shift away from single-source manufacturing has created a once-in-a-generation opening for India. But what’s more significant is that India is no longer just a low-cost manufacturing destination. It is becoming a source of intellectual property and product innovation.

“It’s not just assembly anymore; India is increasingly influencing the product roadmap itself,” Kunwar noted.

From 5G testing to AI camera tuning to device certification, HMD’s India operations now support markets across Southeast Asia, Australia and Oceania, Middle East and Africa.

For many of these global launches, the devices themselves may not come to India, as Kunwar added, but every unit sold overseas has Indian engineering behind it.

Hardware + AI

Smartphone players worldwide are re-architecting their organisations to bring hardware and AI development closer together. India has become the natural location for this convergence.

Reasons being that India offers a strong advantage with its deep AI and data-science talent pool, a growing semiconductor and electronics ecosystem, cost-competitive engineering, a large 5G-ready consumer base, and supportive policies like production linked incentive scheme ( PLI) and component incentives.

Kunwar added that this combination is transformative, stating, “India is one of the few ecosystems where hardware and AI can be co-developed at scale. This changes the game for global smartphone R&D.”

HMD’s trajectory also reflects India’s importance as a hub where global devices are designed, AI frameworks are developed, hardware and durability testing is conducted, and feature innovations for emerging markets are driven.

Meanwhile, Kunwar also hinted that the company will be bringing innovations in the ₹1,000-and-below segment “very shortly”. This is significant, as the feature phone segment remains large, with 55–60 million handsets sold annually, most priced below ₹1,000.

These upcoming devices will focus on delivering real value to consumers, including enabling UPI transactions on low-cost phones, larger batteries to cope with power outages in rural areas, and protection against dust and water splashes.

On AI, Kunwar clarified that a UPI feature on an ₹800–₹900 phone is “more than AI”, because the use case of someone doing a seamless transaction is more valuable.

He added that by 2026, AI-enabled features are expected to appear in phones priced between ₹3,000 and ₹4,000, with innovation also continuing in the smartphone space.

The post India Could Become the World’s Mobile R&D Hub — HMD Global Explains Why appeared first on Analytics India Magazine.